As a financial mode that integrates capital lending and asset leasing and combines trade and technological service, financial lease has become an integral part of the modern service industry and financial industry in China. It has promoted the interaction between capital providers and entrepreneurs, and witnessed rapid development in recent years. In August 2015, the General Office of the State Council issued the Guidelines for Promoting the Sound Development of the Financial Lease Sector, which expressly stated that “financial lease plays an important role in promoting industrial innovation and upgrading, expanding financing channels for micro, small and medium-sized enterprises, propelling growth of emerging industries and improving structural adjustments of the economy”. Thus, financial lease has been recognized as an increasingly important financial mode that serves real economy. According to statistics, as of the end of 2018, the aggregate trading value of financial lease has reached approximately RMB 6,650 billion Yuan, and the number of Chinese financial lease enterprises (excluding single project entities, branches, SPVs and acquired offshore companies) has amounted to more than 10,000, the largest portion of which, about 2,210 are located in Shanghai. Not surprisingly, disputes over financial lease increased at the same time and have become one of the main types of financial disputes heard by the people’s courts. Such disputes uncover certain pressing issues relating to the legal regimes, as well as self-discipline, supervision and regulation of enterprises and markets. This report is hereby made to give an overview of the cases on financial lease contracts heard by Shanghai courts.

I. Characteristics of Financial Lease Contract Cases

A.Number of cases and disputed amount continue to grow

Between 2014 and 2018, Shanghai courts accepted 16,055 first instance cases on financial lease contracts, of which 15,667 (or 97.58%) have been concluded. There is an upward trend in the number of cases accepted. Specifically, 952 cases were accepted in 2014, 2,593 in 2015, 2,975 in 2016, 4,319 in 2017 and 5,216 in 2018 (see Figure 1).

The disputed amount of the accepted cases has amounted to RMB 34.167 billion Yuan (see Figure 2). Both the number of cases and the disputed amount ranked the third among the financial cases of first instance accepted by Shanghai courts.

B.Disputed issues of the cases are concentrated

A lessee’s delay in rental payment is the most common cause of action and still represents the main risk in financial lease. In most of the cases, the lessor, i.e., the financial lease company, initiates an action as the plaintiff to claim for rentals, default interest, liquidated damages and other lease costs. In practice, lessees, repurchasers, guarantors often rely on similar defenses. For instance, lessees typically challenge the quality of the leased assets, the residual value of the leased assets and the amount of rent. Repurchasers typically challenge the validity of the repurchase contracts, repetitive claims of the lessors, repurchase conditions, repurchase price and delivery of repurchased assets. Guarantors typically challenge the validity of the guarantee contracts.

C.Geographic distribution of the cases is concentrated in several areas

To mitigate the operating risks and control the litigation cost, when entering into a contract, in addition to requiring the lessee to provide adequate guarantee, the financial lease company usually requires both parties subject to the jurisdiction of the court in the place where it is located or where the contract is executed (which often being the place where it is located). As a result, the geographic distribution of the financial lease contract cases is evidently concentrated in the places where financial lease companies are located. In Shanghai, Pudong New Area District ranks first, having 60% of all the financial lease cases, followed by Jing’an District (14%), Huangpu District (8%) and Changning District (7%) (see Figure 3).

D.Trials by default are common

As financial lease cases often involve multiple parties and the financial lease companies generally engage in business activities on a multi-regional and geographically dispersed basis, the parties to the disputes are often located in different regions of the country. Most of the lessees are micro, small and medium-sized enterprises in short of funds, and most of the guarantors are the legal representatives, employees or affiliates of the lessees who have no adequate financial strength to resist risks. Once a lessee finds itself in distress or running out of cash, it may transfer the leased assets to escape debts, and the guarantor may transfer the encumbered assets or even disappear. The financial lease company as the lessor is often unable to obtain timely information on the lessee and the guarantor. If no address for service is specified in the financial lease contract, the court often needs to serve notice to the defendants by multiple mails, sometimes even by announcement. Despite successful service, some defendants might choose not to appear in the court for whatever reasons. A large portion of the financial lease cases heard in Shanghai courts in 2018 was conducted in the form of trial by default, which not only extended the duration of litigation but also decreased the trial efficiency.

E.It is difficult to resolve the disputes through mediation

Because of the difficulty in service of process, deterioration of a lessee’s operation and even the disappearance of the lessee or the guarantor, the courts are directly prevented from mediating the disputes. That is why between 2014 and 2018, 74.74% of the cases were solved through judgment. Despite an increase in number, the ratio of the cases dropped or settled after mediation showed a downward tendency (see Figure 4). The main reason is that considering the deteriorating operation and heavy debts of the lessees, the lessors prefer getting a judgment and applying for enforcement as soon as possible, rather than accepting any mediation agreements offered by the lessees for extending the deadline for repayment.

II. Trend Analysis on Financial Lease Contract Cases

A.The number of financial lease cases is expected to continue to grow under the current macroeconomic and industrial policy

The underlying assets of traditional financial lease are limited to special-purpose equipment and other production materials, such as excavators in the construction and engineering industry and high precision printers in the printing industry. As the domestic industrial structures change and the infrastructure demands slowdown, the real economy suffers fluctuations, which has a significant adverse impact on the normal operation and solvency of lessees, thus leading to a great number of disputes and lawsuits involving financial lease. However, during the adjustment of industrial structures, the state has also issued intensive policies to encourage the healthy development of the financial lease industry. Financial lease is expected to flourish in many public sectors, such as agricultural machinery, scientific and technological investment, culture and education, health and infrastructure, as well as sophisticated industries, such as electronic information, big health, energy saving, environmental protection and new energy. As a result, the number of financial lease contract cases is expected to continue to grow, and disputes arising in emerging industries will become more common.

B.Innovative financial lease structures will further complicate the legal relations involved in litigation

The basic transaction structure of financial lease involves three parties, i.e., the lessor, the lessee, and the seller, and two legal relations, i.e., the financial lease relation between the lessor and the lessee, and the sale and purchase relation between the lessor and the seller. In order to satisfy the needs for financial innovation and market development, the lessors have, basing on such basic structure, designed more complex financing products, such as leveraged lease, project lease and venture lease. Meanwhile, to control their operating risk and protect their interests to the greatest possible extent, the lessors tend to adopt credit enhancement measures, i.e., involving repurchasers and guarantors into the financial lease transaction structure. In practice, lessees might assign their right to rental for financing purposes, in which case, other parties, such as third-party private equity investment funds and their investors, might also be involved. Therefore, innovative financial lease products will involve more diversified parties and thus lead to more complicated legal relations.

C.The diversification of leased assets will make the public disclosure of ownership a more pressing issue

Financial lease is based on the separation of ownership and use right of the leased assets. The ownership of the leased assets rests with the lessor, while the right to possess, use and profit from the leased assets is enjoyed by the lessee. Most of the leased assets are movables, and for public disclosure of ownership transfer, delivery is a requisite condition. Therefore, separation of the ownership and use right makes it possible for the lessee to dispose the leased movables without the authorization of the lessor at any time. If a third party obtains the leased assets in good faith, the safety of financial lease can hardly be guaranteed. For the time being, as the leased assets registration system is yet to be developed, the methods available for a lessor are extremely limited for public disclosure of the ownership of movable leased assets. Besides, when the tradition pattern of leased assets was dominated by machinery and equipment used for production and operation, the current financial lease is being more and more frequently found in emerging fields, and the leased assets are now a much more diversified portfolio of manufacturing equipment, consumer goods, and other equipment, rights and even biological resources, which are difficult to be transferred from one possessor to the other upon delivery. Therefore, how to establish a unified ownership registration and public disclosure system to control the risks in financial lease has become a knotty problem, which needs to be solved as soon as possible.

D.The enhanced financing function may make more financing transactions disguised as leases

As its function as a financing tool continues to enhance, sometimes the financial lease is employed for the primary purpose of increasing the leverage ratio and tapping the fullest potential of assets to raise funds, rather than upgrading equipment. Financial lease has become an optional tool to effect other trading purposes, and the substance of its legal relation might deviate from what its name describes. In our trial practice, we can find that some titled financial lease contracts are de facto loan contracts. Some lessors and lessees, taking the advantage of the financing function of financial lease, pursue or conceal their intent of capital lending with invented leased assets to circumvent industrial regulation and legal risks. In particular, they might enter into financial lease contracts for nonexistent leased assets, or exaggerate the value of the leased assets, or falsify the tax invoice of leased assets, or lease equipment that is difficult to be valuated, impractical to be transferred from one possessor to the other or to be specified, or is easy to lose most of its value during normal use, or equipment whose nominal value differs greatly from its actual value. In addition, in some cases, the parties entered into arrangements for investment or sale in the name of financial lease. Defendants of such cases usually rely on relevant judicial interpretations to defend their cases based on the substantial legal relations. Against the backdrop that “financing” is becoming a prioritized purpose in many sectors, the number of such cases is expected to grow further.

III. Issues on Financial Lease Contract Cases and Suggested Solutions

A.Issues on traditional financial lease cases and suggested solutions

1.Ambiguous contractual terms

The first scenario is that there are no definite provisions on the nature of down payment and deposit. It is common for a financial lease contract to provide that a lessee shall pay the lessor certain amount of down payment or deposit upon execution of the contract, but without any definite provision on the nature and purposes of such payment. Not surprisingly, disputes usually arise over the question whether such down payment or deposit serves as advance payment of the rental or as payment independent from the rental.

The second scenario is that there are no definite provisions on the methods of determining the residual value of leased assets. As the payment of rentals is secured by the leased assets, if a lessor requests for termination of the contract, recovery of the leased assets and compensation for loss, it is necessary to determine the residual value of the leased assets. However, in practice, there is little chance to find in a financial lease contract any definite provision on the methods of assessing or estimating such residual value. Once a dispute arises, the parties often have no choice but to appoint a third party to assess such residual value, which will not only delay the litigation but also lead to additional depreciation of equipment.

Suggestion: Lessors should improve their contractual terms, in particular, those concerning the nature and purpose of down payment and deposit, the relation between the quality problem of leased assets and rental payment, the exercising of the right of claims, the liabilities for breach of contract, the methods of assessing the residual value of leased assets and other terms that materially affect the rights and obligations of the parties.

2.Defective performance of contracts

The first scenario is that the lessor collects rental in a non-agreed manner. In principle, the lessee should pay the lessor the down payment or rental as agreed, but in some cases, with the lessor’s express or implicit permission, the lessee entrusts its supplier to pay rentals on its behalf. If the supplier fails to pay the lessor the rentals in a timely manner or withholds the rentals without authorization, the lessor may initiate an action against the lessee to claim the rentals. In some other cases, the supplier pays the down payment on behalf of the lessee, and then enters into a loan agreement with the lessee separately.

The second scenario is that the lessee ignores quality inspection of leased assets. Most of the lessees are micro, small, and medium-sized enterprises. Due to their urgent need of funds and lack of legal and contractual awareness, the lessees are inclined to ignore the quality inspection of leased assets and take delivery of them directly. In some cases, the lessees blur the distinction between financial lease and ordinary lease or mistake the tripartite legal relation among the seller, the lessor and the lessee as a simple loan or sale relation; therefore, after identifying the quality problem of the leased assets, they tend to refuse to pay rentals and rely on such quality problem as a defense against the lessor’s claim for rentals.

Suggestion: Lessors should enhance their service awareness, actively improve the financial lease service, provide lessees with safe and convenient methods for rental payment, avoid unnecessary intermediate process of rental payment, prevent third parties from withholding rentals, and avoid other circumstances that might inflate financing risks. Meanwhile, lessees should enhance their legal awareness, carefully check whether the model of the delivered assets is consistent with the provisions of the finance lease contract, and strengthen the quality inspection of the leased assets.

3.Disputes over the disposal of leased assets

The first scenario is that the lessor repossesses leased assets without any notice. Under financial lease contracts, the lessor usually takes its contractual advantage to incorporate a term which provides that it has the right to repossess the leased assets when the lessee breaches the contract. In some cases, upon a breach by the lessee, the lessor took back the leased assets without any notice. In such case, the lessee typically asserts that despite its breach, the lessor’s recovery of leased assets without giving a notice and a reasonable time period is inconsistent with relevant laws. The parties often dispute over the nature of the lessor’s recovery of the leased assets without a notice, whether such an act constitutes lessor’s notice of termination of the contract or merely represents lessor’s exercise of right of later execution.

The second scenario is that the lessor disposes the leased assets at its discretion. After recovery of the leased assets, some lessors directly sell or otherwise dispose the assets. In litigation, the lessees typically challenge the disposal value of the leased assets and assert that the sale price is obviously lower than the actual value. In such case, as the leased assets have been delivered, it is impractical to determine the actual value upon a third party’s evaluation. Therefore, such act of the lessors is highly likely to lead to disputes and litigations.

The third scenario is that the agreed total amount of rental and liquidated damages are unreasonably high. Usually, the rental under a financial lease contract should be determined based on the full or substantial purchase cost of the leased assets and the lessor’s reasonable profit. But there is no definite standard for determining the lessor’s reasonable profit. For instance, the rentals under some financial lease contracts exceed the purchase price of the leased assets by 24% or even 36%, and in addition to the high rentals, the lessees are also required to pay liquidated damages upon breach of contract. Another example is that a financial lease contract provides that, if the lessee breaches the contract, in addition to requiring the nonperforming lessee to pay liquidated damages, the lessor is also entitled to the deposit paid by the lessee. Therefore, the lessee makes a defense that the total amount of rental and liquidated damages is too high.

Suggestion: First, as the provider of the standard contract, the lessor shall, at the request of the lessee, present and explain the terms of the contract, especially those exempting or limiting its liabilities, in order to avoid any dispute over the validity of the terms of the contract. Second, the lessor should request the lessee to undertake liabilities for breach of contract in accordance with the contract and applicable laws rather than disposing the leased assets at its own discretion, so as to avoid affecting the lessee’s normal production and operation, further worsening the lessee’s performance ability and intensifying the conflict. Third, the lessor should set reasonable amounts of rental and liquidated damages, reasonable standards for deciding the liquidated damages, and refrain from pursuing unreasonably high profits.

B.Issues on sale and leaseback cases and suggested solutions

1.Lessors fail to strictly check the authenticity of leased assets

Under the sale-and-leaseback mode, lessees take lease of their own assets, and the parties are inclined to pay more attention to the financing part but less attention to the assets leasing part. Therefore, the authenticity of leased assets needs to be checked and confirmed by the parties before entering into the contract. For instance, under certain sale-and-leaseback contracts, there actually exists no leased assets; if the lessor under such a contract initiates a lawsuit to claim rentals from the breaching lessee, the lessee might, on basis of the non-existence of the leased asset, defend itself by requesting the court to declare the contract void and invalid or lodge a counterclaim. In addition, certain sale-and-leaseback contracts fail to clearly specify the leased assets. Usually, a lessee takes lease under a sale-and-leaseback contract only part of its owned assets or equipment. If the lessor fails to check or specify the leased assets, a third party may dispute with the lessor on the basis of the defects in the ownership or acquisition in good faith. Financial lease has the dual characteristics of financing and assets leasing; therefore, if there is no leased asset or the leased asset fails to be specified, the transaction should be deemed as simple capital lending without assets leasing, which frustrates the purpose of the financial lease and will definitely undermine its legal status. Furthermore, there is also controversy on whether a lessee may transfer to the lessor leased assets subject to restrictions on right of disposal.

Suggestion: Although a lessor is not expressly required by the law to check the leased assets, the authenticity and specification of the leased assets is still an important element for identifying a sale-and-leaseback transaction. Therefore, lessors should strictly review the certificates provided by the lessees (i.e., the vendors) to prove their right to dispose of the leased assets, including purchase invoices, contracts, specifications, quality certificates, etc., inspect on-site the authenticity of the leased assets, and check, mark and register the transferred assets in detail.

2.It is difficult to determine the actual value of the leased assets

Under the direct lease mode, the leased assets are generally purchased from a third-party vendor, and if there is a dispute over the actual value thereof, it can be determined based on their market value as well as the relevant purchase certificates (e.g., tax invoices). Under the sale-and-leaseback mode, however, as the vendor is also the lessee and some leased assets are produced by the lessee itself while others are purchased from the resale market, their market value is hard to determine. In the absence of the relevant purchase certificates, a dispute is quite likely to arise. The determination of the actual value is crucial for answering the question whether the transfer price is reasonable. In accordance with the rules issued by the Ministry of Commerce and the China Banking and Insurance Regulatory Commission, when purchasing the leased assets, financial lease companies shall refer to reasonable pricing basis which does not violate applicable accounting standards. In such cases, lessees often deny the existence of sale and leaseback by asserting that there is an unreasonably great gap between the actual value and the transfer price of the leased assets. Such gap takes two forms, i.e., “high price for low value” or “low price for high value”. Due to the privileged position held by lessors, most of the leaseback transactions take the form of “low price for high value”, such as “purchase at half-price or discounted price”. There are controversies over the question whether such act should be recognized as a sale-and-leaseback transaction, in which the free will of the parties should be respected to the extent no legitimate rights and interests of a third party is damaged, or be identified as a lending transaction, in which the true intention of the parties is financing and intervention by judicial authorities is justified as the equity principle is violated. In a minority of cases, there are also circumstances where low-value assets are purchased at a high price, and the lessees often argue that the lessors have entered into lending transactions in the disguise of sale and leaseback, thus going beyond their scope of business.

Suggestion: Lessors under the sale-and-leaseback mode should discuss with lessees the extent to which the leased assets can secure the debt owed to the lessors and the scope of the debt that such assets can cover, and agree on a reasonable price of such assets; if necessary, qualified auditors or valuers may be engaged to prevent any dispute arising from the difference between the transfer price of leased assets and their actual value.

3.The ownership of the leased assets fails to be transferred to the lessees

Acquisition of ownership by the lessor is one of the key legal elements for identifying a financial lease transaction. As the leased assets are always possessed and used by the lessees, in assessing whether the ownership of the leased assets has been transferred from the lessees to the lessors, we must have regard to the theory of property rights delivery and the facts about the performance of the contracts. For instance, according to the Property Law of the People’s Republic of China, to be effective, the transfer of the ownership of real estate must be registered. Therefore, in a sale-and-leaseback case where the leased asset is real estate, if the lessor enters into the contract knowing that the ownership of the real estate cannot be transferred, the court would hold that parties’ true intention is capital lending rather than financial lease. In addition, in some sale-and-leaseback cases, the lessees transferred to the lessors leased assets of which the lessees have no right of disposal. For example, prior to the transfer, the leased assets have been subject to mortgage or other encumbrances, or have been sequestrated or attached. When the lessees argue that such transfer constitutes unauthorized disposal, and if the lessors fail to meet the legal conditions for acquisition of ownership in good faith, the court is unlikely to recognize the transaction as sale and leaseback.

Suggestion: Financial lease companies engaged in sale-and-leaseback business should not only reach an agreement with the lessees on transfer of leased assets, but also make every effort to make sure that the ownership of the leased assets is transferred to the lessor by delivery in the case of personal property, or registration in the case of real estate, so as to mitigate financial lease transaction risks.

C.Issues on repo-type financial lease cases and suggested solutions

1.Lessors fail to notify repurchasers in time of the repurchase obligation

Under the repo-type financial lease, the manufacturer or seller of the leased assets acts as the vendor, and is obligated to repurchase the leased assets when the lessee fails to pay the rental or otherwise breaches the contract. The lessor and the repurchaser agree that upon satisfaction of the conditions for repurchase (e.g., the lessee delays in rental payment for a certain period of time), the repurchaser shall repurchase the leased assets upon receipt of the notice sent by the lessor. In practice, however, some lessors fail to notify the repurchaser upon satisfaction of the repurchase conditions, but do so upon the expiry of the financial lease contract. As the repurchase price is linked with the time elapsed after the satisfaction of the conditions for repurchase, i.e., the later the lessors send the repurchase notice, the higher the repurchase price will be, the repurchasers will typically challenge the repurchase price alleging that the lessors failed to notify them in time with an intention to increase the repurchase price. On the other hand, the lessors argue that it is their contractual right to notify the repurchasers to perform the obligation of repurchase and that they can exercise such right at any time as long as the lessees have delayed in rental payment for an agreed number of days.

Suggestion: The parties should perform the contract lawfully and properly in accordance with the principle of good faith. The lessors should, in strict compliance with the contracts, notify the repurchasers to perform the repurchase obligation upon the satisfaction of the conditions for repurchase, so as to avoid any decrease in the value of the leased assets and any aggravation of the repurchasers’ responsibilities for repurchase. The repurchasers should actively perform the agreed obligations and responsibilities. And upon becoming aware of the satisfaction of the conditions for repurchase, the repurchasers may take the initiative to negotiate with the lessors on repurchase, so as to minimize any possible loss.

2.Delivery of leased assets to the repurchaser becomes impossible

If the lessee breaches the contract, the lessor may, in accordance with the repurchase contract, initiate a lawsuit to request the repurchaser to perform the obligation of repurchase. It is agreed under the repurchase contract that the lessor shall notify the lessee to deliver the leased asset to the repurchaser, i.e., delivery to the order of the lessor. Thus, if it has become impossible to deliver the leased assets, a dispute arises over the question that whether the repurchaser is still obligated to repurchase such assets. For instance, the lessee may has actually become unable to deliver the leased assets because the same have been attached by a court or are subject to security interests. In some other cases, where the leased assets have been lost, a dispute arises over the question that whether the repurchaser may rely on such facts to defend the lessor’s claim for repurchase. Disputes over such issues are essentially different understandings of the nature of a repurchase contract. Lessors typically assert that a repurchase contract is in essence a security contract, and the repurchasers’ obligation to pay the repurchase price represents a guarantee liability, which has nothing to do with the question whether the lessees have made delivery to the order of the lessors or whether the leased assets can be delivered. On the other hand, repurchasers argue that repurchase contract is in essence a conditional sale and purchase contract, which implies the existence of the underlying assets as consideration for repurchase price; therefore, they have no obligation to repurchase the leased assets if such assets cannot be delivered.

Suggestion: A repurchase contract has the dual nature of guarantee contract and sale and purchase contract. Absence of general consensus over the application of laws, lessors should improve the terms in the repurchase contract, clarify their effects on the lessees, and request for repurchase upon the satisfaction of relevant conditions and fix and keep relevant evidence. On the other hand, repurchasers should raise their risk awareness. When negotiating the repurchase contracts, repurchasers should focus on terms governing the practicability of the delivery of the underlying assets, and clearly define the risks sharing of damage and loss to the underlying assets to be repurchased.

D.Issues on financial lease of special assets and suggested solutions

1.Consumables as the underlying assets of financial lease

Financial lease, being a type of lease, shall have underlying assets that are suitable for lease purpose and can be returned upon expiry of the financial lease contracts. If it is inherently impossible for an underlying asset to be returned after normal use and upon expiry of the contract, such underlying asset will be deemed as unsuitable for financial lease, and the corresponding legal relation will not be recognized as financial lease. In the cases we tried, some financial lease contracts have as their underlying assets “a batch of decoration materials” and others “mudguards”. In a case where a lessor required a lessee in breach to return the leased assets, the court held that the contract in question, though titled financial lease contract, was in fact a loan contract, because the leased assets were consumables and had not been specified. In addition, to circumvent the restrictive provisions on leased assets, certain financial lease companies choose to set up trading companies and enter into the so-called sales contract, under which the seller retains the title to paper, pulp or other consumables and the buyer makes payment in instalments. Most of the defendants of such cases would argue that they had actually entered into a loan contract.

Suggestion: Of course, the current financial reform and innovation aims to channel more resources to real economy rather than virtual economy, and sets as one of its goals to expand the financing channels for micro-, small-, and medium-sized enterprises; the lessors in the context of innovation and system reform, however, should in their business development, give heed to the questions that whether the underlying assets of financial lease suit for the purpose of lease and whether their own operations comply with laws and regulations.

2.Enforcement of mortgage in financial lease of automobiles

In financial lease of automobile, lessors and lessees enter into financial lease contracts, under which the lessors, at the request of the lessees, purchase automobiles from vendors and lease them to the lessees. To facilitate the use of automobiles, after paying vendors the purchase price, the lessors will register the automobiles under the name of the lessees but agree with the lessees that the lessors are the actual owners. In addition, the lessors and the lessees will enter into separate mortgage contracts, under which the lessees will create a mortgage over the automobiles in favor of the lessors and complete the mortgage registration. Upon breach by the lessee of the financial lease contract, the lessor will bring a lawsuit claiming against the lessee for all the rental unpaid under the contract and the enforcement of the mortgage over the automobiles. There are considerable controversies over the question whether the mortgage can be enforced in such cases.

Some are of the opinion that registration of leased assets under the name of lessees has been accepted as lawful and valid by Article 9(2) of the Interpretations of the Supreme People’s Court on Several Issues Concerning the Trial of Financial Lease Contract Cases, which removed any legal obstacle to such mortgage. As the mortgage has been publicly disclosed through registration, a lessor may lawfully claim for the enforcement of mortgage. Others believe that the purpose of entering into mortgage contracts and registering the mortgage is to publicize the leased assets and prevent disposal of the leased assets by the lessees without the consent of the lessors. As a matter of fact, there is no agreement between them on creating mortgage, and such creation is a false expression of intention. Moreover, the enforcement of mortgage means termination of the contract, but according to relevant judicial interpretations, it is not allowed to claim for at the same time early termination, i.e., payment of all unpaid rental, and enforcement of mortgage.

Suggestion: Given the specialty of financial lease disputes, a lessor should devise lawful and reasonable claims in litigation to protect its legal rights and avoid unnecessary litigation risks.

IV. Our Recommendations

A. Improve laws and regulations on financial lease

Chapter 14 of the Contract Law of the People’s Republic of China and the Interpretations of the Supreme People’s Court on Several Issues in the Trial of Dispute Cases over Financial lease Contracts constitute the current and main legal basis for the trial of financial lease disputes. Against the backdrop of tightened regulation and requirements for returning to the original purpose of lease and serving the real economy, the explosive growth of financial lease sector has slowed down; the business scale of this sector, however, is still growing stably and new trading models continue emerging, and initiatives are still vigorously launched by the government for accelerating the development of the sector. The courts hearing disputes over financial lease contracts are still confronted with quite a few procedural and substantive problems. Given the important role of the financial lease sector in the Chinese market economy, we should, having regards to the status quo of the sector in China, improve the relevant legal system, and particularly, promulgate laws and issue judicial interpretations with respect to those new types of legal relationship in financial lease, so as to balance the interests of the parties concerned, bring the law into full play to regulate, guarantee and guide the development of financial lease market, optimize the industrial structure, and support the innovation and development of the financial lease business.

B. Further develop the risk control system

Financial lease companies shall standardize their business process and establish sound internal risk control system. Specifically, before entering into contracts, they should carefully review the business licenses, tax registration certificates, bank credit and repayment records, financial statements and capital verification reports, so as to understand the lessees’ operating conditions and commercial credit standing, and establish a mechanism to rate a lessee’s credit standings; when entering into contracts, they should incorporate terms regarding the relation between quality problems of leased assets and rental payment, the available remedies, the liabilities for breach of contract, and the methods of determining the residual value of leased assets, so as to clearly define the rights and obligations of the parties; during the performance of contracts, they should take the initiative to coordinate and participate in inspection or on-site supervision of the delivered leased assets, regularly communicate with lessees and obtain the real-time information on the operating conditions of lessees and the use of leased assets.

Lessees should raise their legal and risk prevention awareness, make prudent decision on financing, focus on the contractual protection of their own interests, and may require financial lease companies to explain the relevant terms, if necessary.

Repurchasers and guarantors should strengthen risk prediction and enhance information gathering with respect to the operating conditions of lessees, contract performance and status of leased assets.

C. Establish a sound transaction supporting mechanism

Most of leased assets are movables, and compared with real estate registration authorities, movables registration authorities are numerous, decentralized and more likely to give rise to transaction risks. Given a lack of centralized ownership registration and disclosure system for movables, we suggest that the financial lease disclosure system of the Credit Reference Center of the People’s Bank of China should be improved to protect the rights of financial lease companies to and in their leased assets, reduce the registration and search cost borne by the parties, and provide third parties with access to understand the rights in or to leased assets. In this way, the transaction risks involving leased assets will be mitigated and transaction security will be protected. With respect to the issue that financial lease companies do not have adequate channels for disposal of leased assets, we suggest establishing a fair and efficient mechanism for valuation of leased assets, and developing the secondary lease market, so as to resolve the disputes between the parties over the residual value of leased assets and recycle the leased assets.

D. Strengthen industrial self-discipline and regulation

The financial lease association plays a crucial role in promoting information exchange among enterprises and regulating and coordinating industrial development. As we can learn from those countries with a developed financial lease sector, a financial lease association can bridge the industry and domestic and foreign governments and organizations, and facilitate communications between them. With the first-hand information on and in-depth understanding of the industry, the financial lease association can bring the general demands of enterprises to the attention of government authorities, coordinate as delegated by the government the affairs among the industrial players, and enhance industrial self-discipline and self-motivation. We suggest that the association should be brought into full play in promoting communications among enterprises, strengthening industrial information exchange, reporting industrial demands to the government, unifying industrial rules, regulating industrial operation, and preventing industrial risks, etc. Further to the industrial self-discipline, the regulators should enhance regulation and guidance on new types of financial lease business, maintain the order in the financial lease market, so as to control financial risks while serving and supporting the development of real economy.

|

融资租赁行业2023年回顾与2024年展望

联合资信主要观点:

2023年10月下发了金融租赁公司管理办法,体现了监管机构对

融资租赁行业2023年回顾与2024年展望

联合资信主要观点:

2023年10月下发了金融租赁公司管理办法,体现了监管机构对

2023年租赁业调查报告(毕马威)

毕马威连续第5年发布租赁业调查报告。本刊结合租赁行业热点话题提供专业洞察,并汇总

2023年租赁业调查报告(毕马威)

毕马威连续第5年发布租赁业调查报告。本刊结合租赁行业热点话题提供专业洞察,并汇总

2021年度融资租赁业调查报告

2021年度融资租赁业调查报告

下载地址:原链接

2021年度融资租赁业调查报告

2021年度融资租赁业调查报告

下载地址:原链接

2021年融资租赁行业信用风险展望

一、融资租赁行业 2020 年信用风险回顾

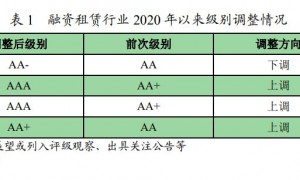

1.信用等级迁移及风险事件回顾

202

2021年融资租赁行业信用风险展望

一、融资租赁行业 2020 年信用风险回顾

1.信用等级迁移及风险事件回顾

202

《金融租赁行业发展报告(2007-2017)》

金融租赁行业发展报告(2007-2017)

《报告》主体内容分为导言、发展篇、环境篇、资产

《金融租赁行业发展报告(2007-2017)》

金融租赁行业发展报告(2007-2017)

《报告》主体内容分为导言、发展篇、环境篇、资产